FINANCIALS – FOR THE YEAR ENDED 30 JUNE 2022

CONSOLIDATED FINANCIAL OVERVIEW FOR THE YEAR ENDED 30 JUNE 2022

We present the consolidated financial report for the year ending 30 June 2022, which includes The Trustees of the Society of St Vincent de Paul (NSW), St Vincent de Paul Society NSW and St Vincent de Paul Housing.

KEY FINANCIAL RESULTS INCLUDE:

- Consolidated net operating deficit excluding significant one offs as per below $17.8M (2021: Surplus $25.1M).

- Total revenues and other income of $169.4M (2021: $202.1M), this is a decrease of $32.7M or 16% on prior year.

- Total expenditure of $185.9M (2021: $176.1M), this is an increase of $9.8M or 6% on prior year.

- Government funding decreased by $19.3M or 27% on last year to $53.2M.This included a $27.2M decrease due to the Federal Government Jobkeeper assistance program ending in March 2021 ($24.7M) and the LAC Program ending in September 2020 ($2.5M). Vinnies Services recognised additional funding of $5.5M due to increased demand and COVID-related expenditure. Additional funds of $2.6M were also received under the Emergency Relief COVID Supplementation funding.

- Vinnies Centres sales decreased by $14.6M or 20% on last year to $56.5M. This is mainly attributable to government imposed COVID lockdowns resulting in all stores in our retail network closed for over 3 months.

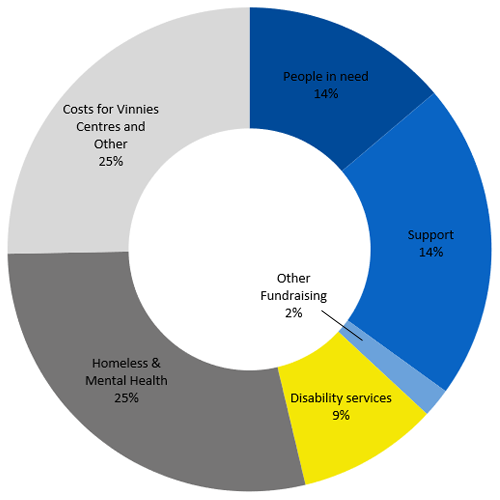

- In 2021‐22, the Society spent $95.9M (2021: $93.2M) directly in the areas of people in need, homelessness and mental health, disability and capacity building services and housing services. This increase was mainly attributed to additional COVID-related expenses.

An overview of the financial results is presented below:

Review of operations

| 2022 Actual $’000 |

2022 Budget $’000 |

2021 Actual $’000 |

2022 vs. 2021 |

2022 Actual vs. Budget |

5 year average % |

|

|---|---|---|---|---|---|---|

| Revenue | 169,422 | 185,398 | 202,145 | -16% | -9% | 1% |

| Expenditure | (185,916) | (184,115) | (176,128) | 6% | 1% | 2% |

| Operating (deficit) / surplus | (16,495) | 1,282 | 26,017 | |||

| Contributions to related entities | (1,288) | (1,478) | (860) | |||

| Net operating (deficit) / surplus | (17,783) | (195) | 25,157 | |||

| Significant one-off items | ||||||

| Net gains on sale | 2,062 | – | ||||

| Amelie Housing Profit (Loss) Share | – | 1,232 | ||||

| Fair value gain on investment properties | 21,051 | 8,730 | ||||

| Net (deficit) / surplus | 5,330 | 35,119 | ||||

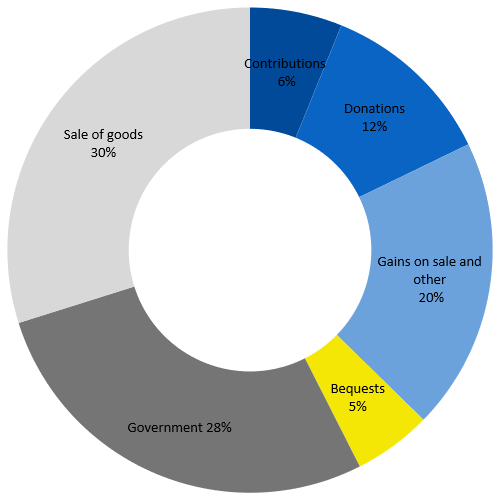

Revenue and other income

2021–22

Use of funds

2021–22

Five-year financial results summary

| 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | Average Change (%) |

|

|---|---|---|---|---|---|---|

| Revenue & other income (‘$000) | ||||||

| Donations & appeals | 15,337 | 17,375 | 26,459 | 22,893 | 22,477 | |

| Bequests | 6,926 | 17,874 | 13,393 | 10,127 | 10,021 | |

| Sale of goods & other | 67,963 | 69,045 | 57,181 | 71,990 | 57,475 | |

| Government funding | 98,953 | 103,810 | 106,715 | 72,444 | 53,179 | |

| Client contributions | 5,321 | 8,700 | 10,074 | 11,236 | 11,828 | |

| Gains on sale of assets | 4,225 | 2,398 | 6,443 | 699 | 2,759 | |

| Other | 9,564 | 16,103 | 12,396 | 22,719 | 34,795 | |

| Total revenue & other income | 208,289 | 235,305 | 232,661 | 212,107 | 192,534 | |

| Year-on-year change (%) * | 13.5% | 13.0% | -1.1% | -8.8% | -9.2% | 1.5% |

| Use of funds ($’000) | ||||||

| Fundraising costs | 4,023 | 3,919 | 4,339 | 3,508 | 3,607 | |

| Costs for centres of charity and other | 49,079 | 52,170 | 50,549 | 50,005 | 47,009 | |

| People in need | 23,940 | 40,387 | 29,264 | 25,571 | 25,688 | |

| Homeless, mental health and housing | 50,424 | 55,178 | 64,327 | 48,665 | 52,852 | |

| Disability Services | 73,546 | 62,319 | 55,312 | 18,996 | 17,440 | |

| Other costs | 21,866 | 46,164 | 35,393 | 29,333 | 39,320 | |

| Impairment and losses on assets | 3,536 | 435 | 10,645 | 50 | – | |

| Total expenditure | 226,414 | 260,572 | 249,829 | 176,128 | 185,916 | |

| Year-on-year change (%) * | 20.6% | 15.1% | -4.1% | -29.5% | 5.6% | 1.5% |

| Contributions to related entities | 1,178 | 1,708 | 1,216 | 860 | 1,288 | |

| Net surplus / (deficit) | (19,303) | (26,975) | (18,384) | 35,119 | 5,330 | |

| Services % of total costs* | 88.4% | 80.7% | 83.4% | 81.3% | 76.9% | 82.2% |

| Services % of total income* | 94.6% | 89.3% | 85.7% | 67.5% | 74.3% | |

| Fundraising costs % of total costs* | 1.8% | 1.5% | 1.8% | 2.0% | 1.9% | |

| Fundraising & admin % of total costs* | 11.6% | 19.3% | 16.6% | 18.7% | 23.1% | 17.8% |

| Fundraising costs to donations & bequests* | 18.1% | 11.1% | 10.9% | 10.6% | 11.1% |

* Net gains on sale, impairment losses and restructuring provisions have been excluded from ratios as they are one-offs.

CONSOLIDATED FINANCIAL OVERVIEW FOR THE YEAR ENDED 30 JUNE 2022

Operating position

The Group reported a net operating surplus for the year of $5.3M (2021: $35.1M). Included in the net surplus are significant one off items of 1) $21.1M fair value adjustment to the St Vincent de Paul Housing properties. 2) $2.1M net gain on property sales.

In FY2022 the Society responded to the flood crisis in the North East of New South Wales by quickly launching a flood appeal and generating $4.4M. In addition the Society received $1.3M in ER flood assistance funding, in total generating $5.7M. The Society started issuing assistance to households directly affected straight away in the form of one off grants totalling $3.9M as well as vouchers and other assistance totalling $227k. Assistance continues to be provided locally by Conferences in affected areas with the remaining funds available.

COVID-19 impact and measures in place

The second wave of the COVID‐19 pandemic in June 2021, that led to a lockdown, had a significant impact on our revenue streams including fundraising, retail and investments. The Group implemented a number of strategies to reduce our expenditure during this period including:

- establishing our eligibility for Jobsaver and commencing the rollout of this scheme;

- standing down staff in areas where operations have ceased or been significantly reduced;

- ceasing the use of casuals where possible to support the retention of permanent staff;

- implementing a recruitment freeze across the organisation (unless deemed business critical);

- planning for reducing and deferring operational and capital expenditure

- reducing excess annual and long service leave.

We are continuously monitoring our financial position with robust and timely forecasting of key financial information to assess and put additional measures in place as appropriate.

Cash and Financial position

The Group is fortunate to be in a sound financial position with net assets at 30 June 2022 of $399M. The main components of this are property assets of $489.3M, also cash assets of $66.9M and strategic and other deposits of $47.7M.

FY2022 saw the continuation of the Society’s strategic plan which places the people we serve at the centre, surrounded by our mission, vision, values and spirituality this ensuring the Society’s resources are allocated to priority service delivery areas which have been identified by the Board. The strategic plan has been extended to the end of FY2023.

The objective of the Society’s Strategic Reserves are primarily to safeguard against the risk of major unforeseen events, ensuring the long-term sustainability of the Society and its activities to support those most in need. Furthermore, these funds are utilised to fund major strategic initiatives presented to the Board, subsequent to review by the Audit and Finance (AF) Committee. The Society’s plan for 2022-23 is the continuation of investments that will further build organisational capability to ultimately support service delivery to the people we assist.

Trends and ratio analysis

Over the last five years, operating revenues have increased on average by 1.5%. Over the same time operating expenses have increased by 1.5% on average.

The ratio of service delivery costs as a percentage of total costs is in line with the 5 year average of around 82.2%.

The ratio of fundraising and administration costs as a percentage of total costs is 23.1%. It should be noted that included in these costs were interest expense of $3.3M on the SVDP Housing loan and $4.8M on fair value loss on financial assets. The adjusted ratio excluding these costs is 19.4% which is higher than the 5 year average of 17.8% due to loss of revenue caused by the COVID-19 imposed lockdowns.

Analysis of results

Sales of goods from Vinnies Centres represent a significant contribution to total revenues at 29% (2021: 34%). As observed in the wider retail sector which our shops operate, there were challenging market conditions including significant COVID‐19 restrictions which saw the closure of all our retail outlets for three months and had a significant impact on the results for FY2022.

Government funding decreased during the year to $53.2M, however representing a significant contribution to total revenues and other income at 28%. The Society is fortunate to receive significant funding from the Government, however many of our services are co-funded by the Society, as can be seen by our spending of $95.9M in areas of people in need, homeless and mental health services, disability, capacity building and housing services. As such these shortfalls are sustained by surpluses generated from Vinnies Centres, donations, client contributions and cash reserves.

Donations and appeals contributed 12% to total revenues and other income (2021: 11%).The 2022 CEO Sleepout raised approximately $3.2M for crisis accommodation and specialised services for those experiencing homelessness.

Bequests performed strongly generating $10.0M (2021: $10.1M) and accounted for 5% (2021: 5%) of total revenues and other income. The Society is very appreciative of these valued gifts which are applied directly as per the instructions of the Estate. Bequests are unpredictable in nature, as such for budget purposes the Society applies a five year historical average with an appropriate growth target.

Investment income which is comprised of interest and dividends and fair value gains on investments showed an unfavourable result of $3.3M, in comparison to FY2021. This is mainly attributable to the downturn of the Australian Share Market due to the COVID pandemic, war in Ukraine, supply chain disruptions, high inflation, rising interest rates and fears over a possible global recession, which saw share prices falling by around 10% in FY2022.

Jack de Groot

Chief Executive Officer

Dated this 29th day of October 2022

Jean-Baptiste (JB) Naudet

Chief Financial Officer

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2022

| 2022 $ |

2021 $ |

|

|---|---|---|

| Revenue | 192,534,650 | 212,107,439 |

| Fundraising costs | (3,607,231) | (3,508,345) |

| Costs for Vinnies Centres | (46,599,648) | (49,648,177) |

| Cost for sales – other | (409,717) | (357,278) |

| People in need services | (25,688,468) | (25,571,100) |

| Homeless and mental health services | (48,303,949) | (44,372,663) |

| Disability services and capacity building | (17,439,968) | (18,995,508) |

| Housing services | (4,548,129) | (4,292,834) |

| Support and enabling function costs | (29,202,843) | (25,947,142) |

| Contributions to related entities | (1,288,254) | (860,453) |

| Fair value loss on financial assets | (4,849,445) | – |

| Loss on disposal of fixed assets | (32,877) | (49,631) |

| Finance costs | (5,233,995) | (3,385,403) |

| Total expenses | (187,204,524) | (176,988,534) |

| Surplus for the year | 5,330,126 | 35,118,905 |

| Other comprehensive Income | ||

| Other comprehensive income for the year | – | – |

| TOTAL COMPREHENSIVE INCOME FOR THE YEAR | 5,330,126 | 35,118,905 |

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2022

| 2022 $ |

2021 $ |

|

|---|---|---|

| ASSETS | ||

| Current | ||

| Cash and cash equivalents | 66,856,886 | 75,025,285 |

| Trade and other receivables | 4,378,469 | 3,871,518 |

| Inventories | 367,323 | 220,325 |

| Other assets | 1,331,160 | 8,241,589 |

| Current assets | 72,933,838 | 87,358,717 |

| Non-current | ||

| Trade and other receivables | 989,093 | 5,669,683 |

| Other financial assets | 48,290,104 | 45,040,676 |

| Right-of-use assets | 25,885,444 | 28,469,682 |

| Property, plant and equipment | 248,963,245 | 253,910,170 |

| Investment properties | 244,330,458 | 223,293,454 |

| Intangible assets | 3,260,805 | 2,921,497 |

| Total non-current assets | 571,719,150 | 559,305,162 |

| TOTAL ASSETS | 644,652,988 | 646,663,879 |

| LIABILITIES | – | |

| Current | ||

| Trade and other payables | 14,355,596 | 14,301,560 |

| Other liabilities | 10,097,536 | 9,205,641 |

| Borrowings | 2,249,390 | 430,587 |

| Lease liabilities | 5,852,099 | 5,719,925 |

| Employee benefits | 12,239,423 | 11,081,345 |

| Total current liabilities | 44,794,044 | 40,739,058 |

| Non-current | ||

| Borrowings | 176,978,958 | 179,970,873 |

| Lease liabilities | 21,154,807 | 23,741,954 |

| Employee benefits | 2,056,046 | 1,760,400 |

| Provisions | 1,130,000 | – |

| Non-current liabilities | 201,319,811 | 205,473,227 |

| TOTAL LIABILITIES | 246,113,855 | 246,212,285 |

| NET ASSETS | 398,539,133 | 400,451,594 |

| FUNDS | ||

| Funds for social programs | 9,371,956 | 13,350,537 |

| Equity contribution | 389,167,177 | 387,101,057 |

| TOTAL FUNDS | 398,539,133 | 400,451,594 |

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 30 JUNE 2022

| Equity Contribution | Funds for Social Programs | Total Funds | |

|---|---|---|---|

| Balance at July 1 2020 | 13,350,537 | 351,982,152 | 365,332,689 |

| Profit for the year | – | 35,118,905 | 35,118,905 |

| Other comprehensive income | 0 | 0 | 0 |

| Balance at 30 June 2021 | 13,350,537 | 387,101,057 | 400,451,594 |

| Balance at 1 July 2021, reported | 13,350,537 | 387,101,057 | 400,451,594 |

| Opening balance adjustment | – | (3,264,006) | (3,264,006) |

| Equity contribution | (3,978,581) | – | (3,879,581) |

| Profit/(deficit) for the year | – | 5,330,126 | 5,330,126 |

| Other comprehensive income | – | – | – |

| Balance at 30 June 2022 | 9,371,956 | 389,167,177 | 398,539,133 |

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 30 JUNE 2022

| 2022 $ |

2021 $ |

|

|---|---|---|

| CASH FLOW FROM OPERATING ACTIVITIES | ||

| Receipts from customers and others, gross of GST | 174,936,923 | 191,986,238 |

| Payments to client, suppliers and employees, gross of GST | (157,181,494) | (168,478,852) |

| Net distributions to related entities | (1,288,254) | (860,453) |

| Interest expense on lease liability | (1,547,889) | (1,345,346) |

| Net cash used in by operating activities | 14,919,286 | 21,301,587 |

| CASH FLOW FROM INVESTING ACTIVITIES | ||

| Net proceeds from / (purchase of) investments | (11,209,276) | 483,169 |

| Interest received | 757,708 | 839,770 |

| Dividend income | 786,719 | 284,271 |

| Net purchase of property, plant and equipment | (885,074) | (3,595,731) |

| Payments for capital expenditure work in progress | – | (49,371,881) |

| Payments for intangible assets | (1,799,650) | (286,460) |

| Net cash used in investing activities | (12,349,573) | (51,646,862) |

| CASH FLOW FROM FINANCING ACTIVITIES | ||

| Repayment of lease liabilities | (6,970,162) | (6,535,126) |

| Net proceeds from / (repayments of) loans | (630,761) | 47,080,835 |

| Interest paid on ADF loan | (3,296,848) | (3,032,199) |

| Net cash from / (used in) financing activities | (10,897,771) | 37,513,510 |

| Net change in cash and cash equivalents | (8,328,058) | 7,168,235 |

| Cash and cash equivalents at the beginning of financial year | 74,594,698 | 67,426,463 |

| CASH AND CASH EQUIVALENTS AT THE END OF FINANCIAL YEAR | 66,266,640 | 74,594,698 |

DECLARATION BY THE NSW STATE COUNCIL FOR THE YEAR ENDED 30 JUNE 2022

In the opinion of The Trustees of the Society of St Vincent de Paul (NSW);

- the consolidated financial statements and notes of The Trustees of the Society of St Vincent de Paul (NSW) comply with the Australian Accounting Standards – Simplified Disclosures, the Australian Charities and Not-for-profits Commission Act 2012 and associated regulations, and other mandatory professional reporting requirements;

- the attached consolidated financial statements and notes give a true and fair view of The Trustees of the Society of St Vincent de Paul (NSW)’s financial position as at 30 June 2022 and of its performance for the financial year ended on that date; and

- there are reasonable grounds to believe that The Trustees of the Society of St Vincent de Paul (NSW) will be able to pay its debts as and when they become due and payable.

Signed in accordance with a resolution of the Responsible Entities:

Paul Burton

President, NSW State Council

29 October 2022

Sydney